Warehouses are extremely complex environments, requiring a plethora of different hardware and software solutions to orchestrate various workflows and activities. Historically, almost all warehouses used paper-based methods of assigning orders and tracking inventory. However, the end of the 20th century saw the introduction of warehouse management systems (WMS), a computational approach to tracking inventory and managing orders.

More recently, we’ve seen the introduction of hardware solutions like automation and robotics, which have further streamlined warehouse operations. These hardware solutions require additional software, on top of the WMS, to coordinate the movements of the mechatronics and robotics.

Sub-ordinate control software is used to control fine movements of the hardware, while warehouse control systems (WCS) and fleet management systems (FMS) provide the movement logic that enables pallets, cases, totes, and other handling units to get from Point A to Point B through an automated system. Execution software, on the other hand, is used to orchestrate order release and task allocation to optimize a given output (e.g. maximize throughput or minimize cost).

Given the relative maturity of the WMS market, a recent study released by Interact Analysis shows revenue generated from automation-related software solutions growing at a faster rate than warehouse management software. Furthermore, the growth of automation is leading to the blurring of traditional industry boundaries, which is going to lead to significant disruption in the industry over the coming years.

Interact Analysis

Interact Analysis

Strong growth in warehouse software, particularly for automation-related software solutions

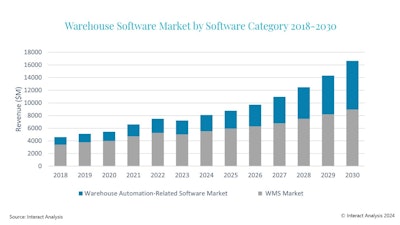

The market for warehouse software reached $7.2 billion in 2023 and is forecast to increase to $16.6 billion by 2030, growing at a CAGR of 13%. As the complexity of warehouses continues to increase and the need to fine-tune logistical processes grows, expect significant growth in the deployment of warehouse software solutions.

Breaking the market up into WMS and automation-related software solutions, the market size for WMS-related solutions reached $5 billion in 2023 and is expected to reach $8.9 billion by 2030, growing at a CAGR of 8.6%. Automation-related software solutions, on the other hand, reached $2.2 billion in 2023, with the market anticipated to expand to $7.7 billion by 2030, growing at a much higher rate of 19.5%.

Warehouse software types analyzed by different software layers

The reason for the differential in growth between WMS-related and automation-related software solutions is that most warehouses have a WMS and growth potential is therefore largely limited to renewals and greenfield warehouse developments. On the other hand, the penetration of automation within warehouses is much lower, resulting in a greater opportunity to automate existing brownfield sites.

The blurring of industry boundaries

The development of warehouse automation is also blurring the lines between what were previously well-defined product categories.

Traditionally, WMS was typically provided by enterprise resource planning (ERP) or supply chain vendors. However, with the development of warehouse automation, some warehouse automation solution providers have begun offering WMS.

Similarly, traditional WMS providers are getting more involved in the orchestration of automation through the development of execution layers embedded into their WMS platforms. Some software providers are going as far as providing a WCS, where the WMS is then able to connect directly to the PLCs.

In other words, automation vendors are looking to move up the value chain by providing more execution and management products, while traditional software providers are looking to move down into the orchestration space through the development of execution layers embedded into their WMS solutions.

Final thoughts

With the growth of the automation market, expect traditional software providers to capture a slice of the pie. However, different software providers are developing different strategies to capitalize on the growth of automation.

Some software providers are relying on third-party interoperability layers to help connect and integrate with automation. Others are developing an in-house library of APIs that are used to connect directly to robotic solutions. Given the changes the industry is facing, it’s more important than ever to stay ahead of the curve and develop a successful automation strategy.